New Getaround service fee structure

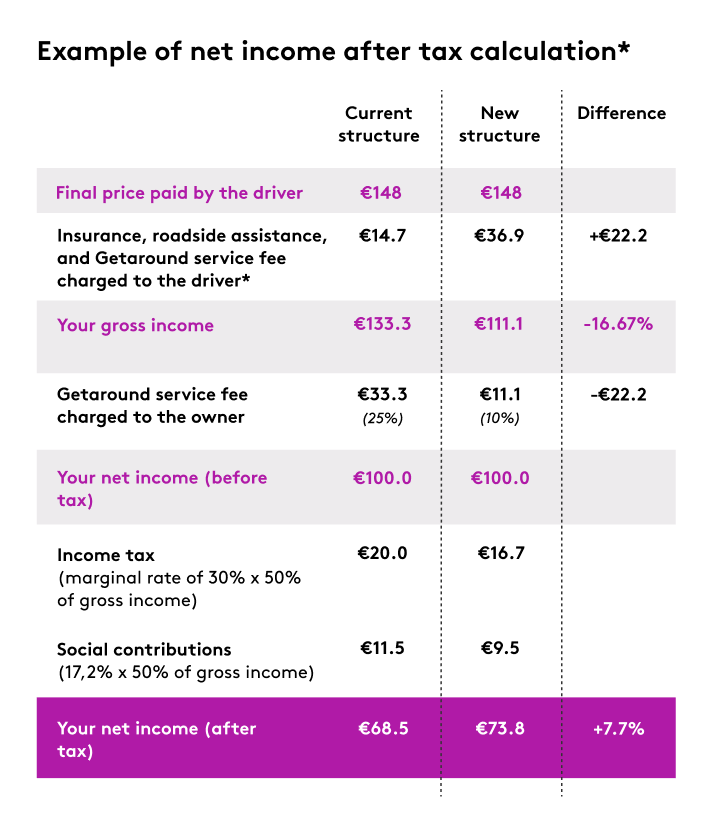

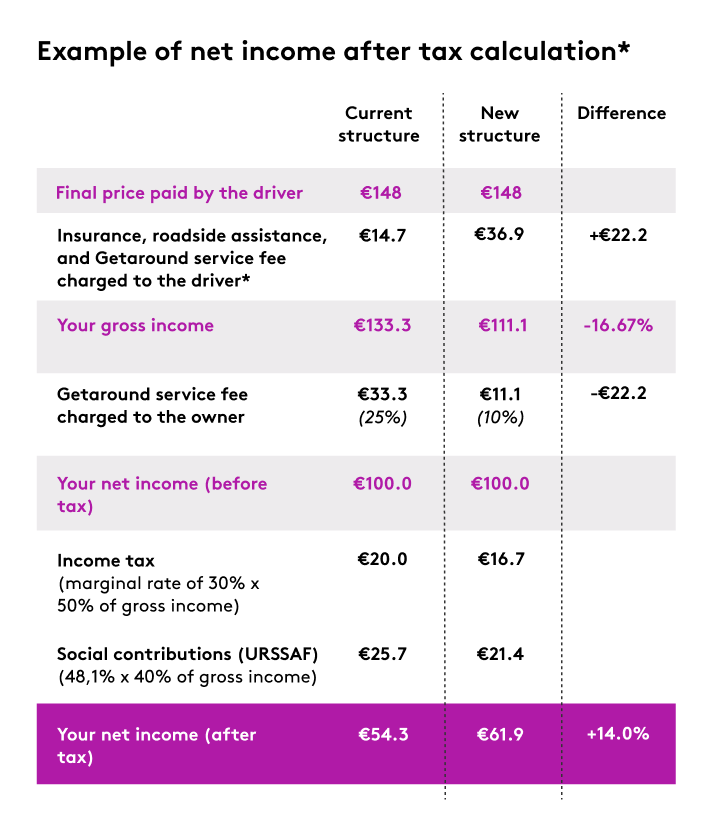

On April 27, 2022, the service fee charged to owners in France by Getaround will decrease from 25% to 10%, and the service fee charged to drivers in France will increase equivalently.

As a reminder, since January 1st, 2019, you must declare your gross personal income generated with Getaround to the tax authorities every year.

This gross personal income, which you can see at any time from the Payments page, is made of the amount paid into your bank account plus the owner service fee.

The decrease of the owner service fee will reduce your tax base and raise your net income after tax. The gain may vary depending on your personal situation, your marginal tax rate and gross rental income.

Peer owners with rental income of less than €8227/year

Your rental income doesn’t exceed the €8227 threshold. You pay the income tax and social contributions ("prélèvements sociaux").

*Illustration for an owner subject to the Micro-BIC regime with a marginal tax rate of 30%, a rental income < 8227€ and a 25% service fee rate charged by Getaround. The rental price and the cost of insurance, roadside assistance, and Getaround’s service fee charged to the driver depend on the rental criteria. Typical illustration of a three-day, pre-booked non-Connect rental for a category 1 vehicle in the French province.

Peer owners with rental income of more than €8227/year

Your rental income exceeds the €8227 threshold. In addition to income tax, you’ll also pay social contributions ("cotisations sociales") as part of your taxation.

*Illustration for an owner subject to the Micro-BIC regime with a marginal tax rate of 30%, a rental income > 8227€ and a 25% service fee rate charged by Getaround. The rental price and the cost of insurance, roadside assistance, and Getaround’s service fee charged to the driver depend on the rental criteria. Typical illustration of a three-day, pre-booked non-Connect rental for a category 1 vehicle in the French province.

Automatic update of your reference price

To maintain balanced final prices on the platform and avoid a general increase in rental prices following the rise of the driver service fee, we will automatically adjust your reference prices and decrease them by 16.67%, on April 27.

This update won’t have any impact on your net income before tax that will remain stable compared to the current model. You’ll still be able to update your reference prices after once this automatic update is completed.

If you want to update your reference prices manually, please let us know before April 25, 2022 at 10pm by filling in this form.

Questions about our new service fee structure?

We’ll be hosting a webinar (in French) on April 20, 2022, where we’ll present in detail this change of service fee and answer your questions. Please register to participate.

Frequently asked questions

From April 27, which income do I need to declare?

The income declaration process remains the same: you declare your personal gross income to the tax authorities. This personal gross income, which you can see at any time from the Payments page, is made of the amount paid into your bank account (net personal income) plus the owner service fee. Decreasing the owner service fee reduces your personal gross income that you need to declare: the amount of your tax will thus decrease too.

I have a rental booked before April 27 but starting after April 27. Which service fee will I be charged?

You’ll benefit from the effect of the new model for all rentals booked by drivers from April 27, 2022. For any rental booked before April 27, 2022 but taking place after this date, the rental price and service fee remain the same under the current model.

Does this change have an impact on the URSSAF contribution (cotisation) threshold?

This change does not have an impact on the URSSAF contribution threshold, which is set at €8227 for 2021 and 2022. For more information, refer to the brochure dedicated to the collaborative economy, section 5 (rental of goods) HERE.

However, this change has a positive impact on the rental income you can generate before reaching the URSSAF contribution threshold: since for the same net income, your gross income decreases, this change will allow you to generate more net income before reaching the URSSAF contribution threshold.

How is the owner service fee calculated?

From April 27, 2022, the owner service fee decreases from 25% to 10% for owners in France. This 10% fee is based on your personal gross income.

Example: For €100 personal gross income, the owner's service fee is €10 (10% of €100) and the personal net income is €90 (90% of €100).

What does the driver service fee consist of?

The amount changes based on different criteria, including whether or the car is equipped with Getaround Connect, the duration of the rental, the reference price, and the car's degressivity rates.

Why are my reference prices updated?

The reference price is made of your personal net income and the owner service fee. The decrease of this fee therefore implies a reduction of your reference prices. This will allow you to maintain an equal personal net income while keeping the same rental price attractiveness for your car.

My car uses fixed pricing: what change will you apply to my reference price?

We’ll only update your reference price in the Pricing page of your car.

My car uses variable pricing: what change will you apply to my reference price?

We’ll update your low, mid, and high season reference prices and your “calendar” reference prices that you set in the Price page of your car.

My car uses Smart Pricing: what change will you apply to my reference price?

We’ll update your minimum price and your “calendar” reference prices that you set in the Price page of your car. Moreover, the prices suggested by Smart Pricing will also be updated.